In the payment processing industry just about any company will offer a free statement analysis, but I want to show you how to easily do it yourself by identifying your “net effective rate.”

The net effective rate (also called “effective rate”) is an important factor to consider because it allows you to quickly find out if you’re paying too much for your credit card processing.

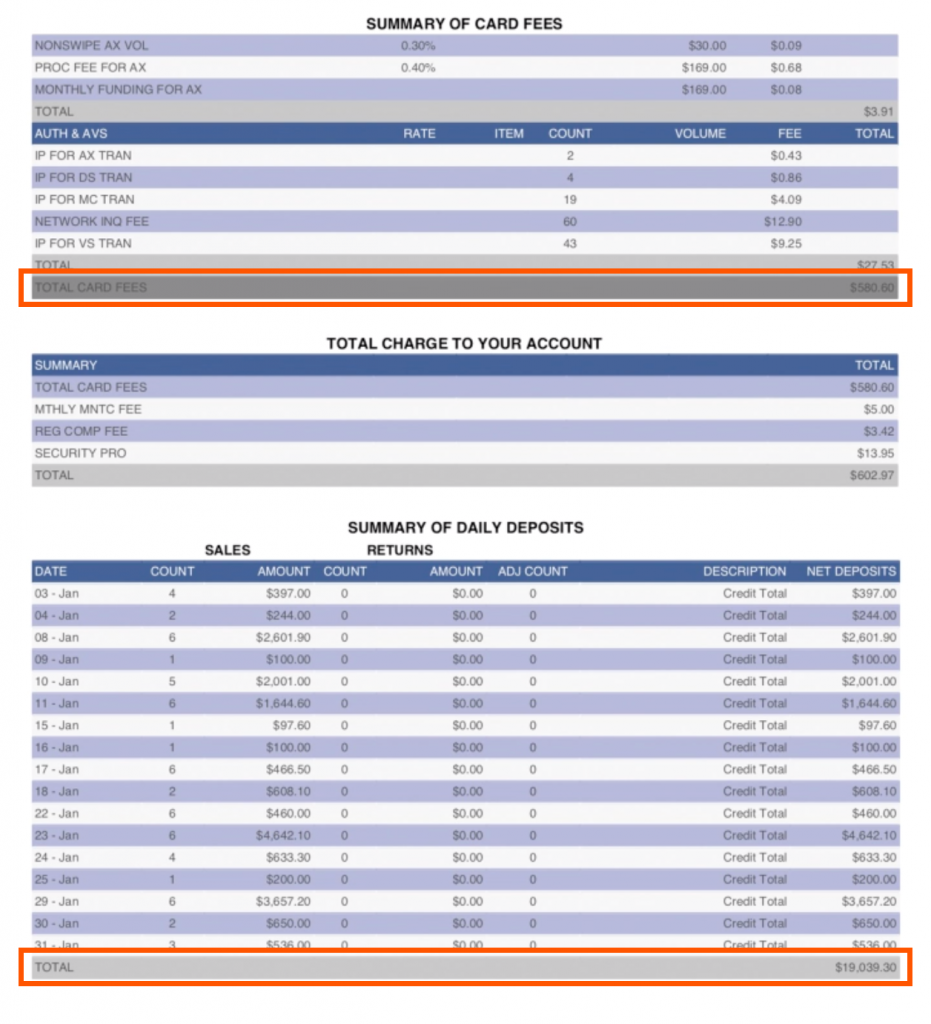

To find your net effective rate, you will need your current merchant statement and a calculator. The easiest way to find your net effective rate is to take your total processing fees and divide that by your total sales volume.

Refer to the below example, which will help illustrate how to calculate your net effective rate:

The net effective rate for this merchant would be: 3.04%

Total fees ÷ Total Volume = Net Effective Rate

$580.60 ÷ $19,039.30 = 3.04%

What this means

So now we know that 3.04% of this merchant’s processing volume goes to credit card processing fees. But what does that mean?

Well, it’s important to note that the average effective rate for credit card processing varies by provider and industry type. For example, a typical merchant account will have an effective rate somewhere between 2.0% to 2.4%. A “typical account” being card present transactions in a traditional setting like retail or restaurant. However, an e-commerce merchant will likely have an effective rate somewhere between 2.6% and 2.9%.

So this means that our example merchant has a higher than the average net effective rate with their current processor and is paying too much for their processing.

To confirm that they are paying more than they should for their credit card processing, they could compare this section of their merchant statement to the fees charged by other processors. Any proposal you receive from a processor should include this figure.

If it doesn’t, just ask.

If a processor will not provide an estimate (or sometimes called a Savings Analysis), one of two things are likely taking place:

- The provider doesn’t work with many businesses like yours, which means you probably won’t receive adequate service.

- The provider is planning on adding additional fees to their service, increasing their profit. Thus sharing the effective rate would probably expose these ‘hidden fees.’

Understanding how to calculate your effective rate is a great way to keep track of how much of your revenue is going towards the cost of accepting credit cards. If your net effective rate seems high, maybe it is time to speak to your merchant services provider…or alternatively, find a new one.

If you need help determining your net effective rate, give us a call at 817-754-1647 or upload an example of your most recent statement here, and one of our specialists will be happy to help.