We know that the card payments industry has maintained a reputation of overcharging for the sake of higher profits for a reason, but we are ready for that to change. At Rev19, we are dedicated to bringing transparency to our industry by exposing the borderline unethical and flat out shady practices currently being used on business owners. One of which is the Billback pricing model.

BillBack Pricing:

You may hear a few different terms for Billback, such as enhanced recover reduced, blended rate or mixed rate. Regardless of what it’s called, any variation of Billback is terrible for your business. What’s worse, this pricing model was designed to deceive and mislead business owners.

In short, a Billback fee is an additional processing charge on a prior card transaction. Processors will initially charge you, the business owner, a low, fixed rate for all transactions processed during your first billing period. Any additional processing fees from this billing period will be passed on to next months billing statement. As a result, you’ll end up needing two months worth of billing statements to get an accurate read on what your processor has charged you in total for that specific month.

Let’s break it down even more:

Let’s say your processor charges you a flat rate of say 1.5% for all of your transactions each month. However, it’s important to know that all transactions are not equal. MasterCard and VISA each have a set of fixed rates, called interchange fees, that are used to determine how much each type of transaction costs (i.e., a rewards card will have a different interchange rate than a debit card). This means some transactions will have a higher rate than others, even higher than the 1.5% fixed rate the processor is charging you. As an example, let’s say the cost of a MasterCard transaction is 1.75%, but the processor is only charging you the 1.5% fixed rate for that transaction. How does the processor recoup the difference?

In the first month, the processor will charge you the 1.5% fixed rate for every transaction that month, regardless of its interchange category. The following month, your processor will bill you for the difference owed for that transaction. So in this case, you would be charged an additional .25%.

Card processors that use this tactic bank on you not knowing how this works so that you think you’re paying one rate for all transactions you take.

Think that’s bad? An additional pricing model was spawned from the Billback principle to create even more profit for the processor, which is known as Enhanced Billback pricing. The only difference is the processor adds an additional fixed percentage markup, hence the reason why they call it “enhanced.” In addition to paying more than promised, you’re also paying a markup just because your processor can easily add it into complex statements.

How to identify Billback:

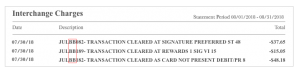

The good news here is that once you know what to look for, you’ll be able to determine if you’re on a Billback pricing model. Billback fees will usually be listed in the “Interchange” section marked with the code “BB.”

Note: The statement period is for August, but the transactions are from July.

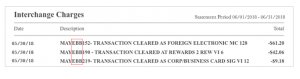

You’ll have a similar statement if you’re under Enhanced Billback, however, instead of “BB”, it will have the acronym “EBB.”

Note: The statement period is for June, but the transactions are from May.

Notice how the processing volume and fee breakdown (authorization fee x # of transactions) are left out on the statements? This is intentional so that you are unable to determine the rate you are paying for the markup.

So, without two consecutive statements, there is no way to see the actual rates paid.

What to do if you’re on Billback:

We’ve seen it time and time again; unethical credit card processors will promise you a low, fixed rate but will fail to mention what’s to follow. Don’t be fooled. If your statement matches the statement in this article, contact your processor to have them change your pricing model immediately. If you’re unsure and want peace of mind, we are happy to help you review your statements!

1 Comment

Very well written article. I am completely uneducated on all of this really. The article was clear, consider, and each had a simple understandable example to illustrate each “mini” topic within the essay.

Really great article.

Thanks Rev19