You’re already well aware of the fact that modern day businesses require the ability to accept credit cards from their customers. Cash exchanges are becoming fewer and farther between, while card swipes and online transactions dominate the marketplace. Maybe you already know this, but maybe you don’t know which credit card readers work best for your business, or even how to do the research to narrow down your options. Not all card readers and point of sale systems are created equal but can be very diverse in their practical functions. Here’s a breakdown of the most popular features you need to know about, and a few tips for shopping around as you strategize payment methods for your company.

Connecting

It goes without saying that you’re going to have to connect your terminal to the internet so transactions can transfer between bank accounts. There is a myriad of ways to connect your card reader, including a phone line, Ethernet, WiFi or 3G. Keep in mind that anything requiring a phone line will need its own dedicated line and essentially be immobile. This isn’t an issue for traditional terminals which usually live on a countertop, however there are plenty of wireless and battery powered options that offer greater mobility. Mobile swipers are growing in popularity, especially for restaurants, and can either plug into a phone audio jack or connect via Bluetooth. Mobile card readers are great solutions for markets, trade shows, and any event where you don’t want to be stuck in one place.

Hardware

Make sure to ask your merchant service provider for a list of hardware options so you can make an educated decision before committing to a purchase. There are so many options, and they all work well with different business models. A high traffic restaurant and bar will need something very different than a hair stylist or boutique. Make a list of the daily functions you know you will need and go from there. Every business needs something a little different, so knowing what your day-to-day will look like can point you in right direction for your purchase.

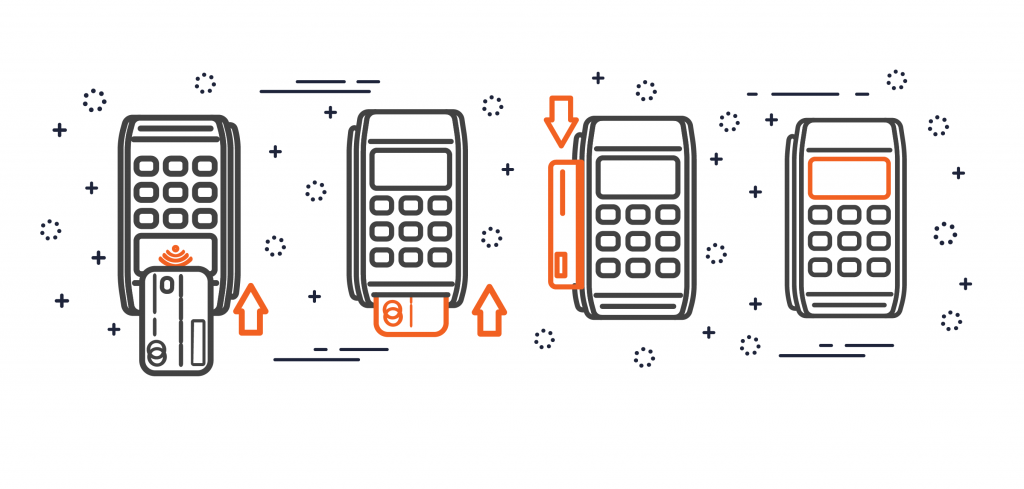

EMV & NFC

Have you noticed the increase in chip reader cards everywhere you go? These chips, also known as EMV cards, offer more security by using encryption and are quickly becoming the most dominant payment method across the U.S. Essentially eliminating opportunity for theft, these chip readers are soon to take over the entire industry. A similar solution escalating across payment platforms is NFC (near field communication) used in the form of a mobile wallet such as ApplePay where a customer can simply tap their mobile device on the card reader to initiate payment. It’s important to choose updated hardware that accepts these forms of payment so you can cater to the preferences and trends of your loyal consumers. For a more in depth understanding of these payment alternatives, check out our recent post here.

Leasing & Buying

Some merchant service providers don’t offer purchasing hardware as an option but require business owners to enter a lease. Be wary of these obligations, as leasing payment equipment is usually much more expensive than buying. It may seem more cost effective at the time, especially if you’re a start-up and don’t want to take on a lot of large purchases. But the lease could end up costing you 5-10 times more than the actual price of the terminal, and you’re better off making the investment up front. Some providers will sell you the equipment at cost, which is a smoking deal compared to paying an absurd amount of money that locks you into a long-term commitment with a piece of equipment that may out date itself before you finish paying it off.

Do you still have questions about which card reader is the best one for you? Give us a call! Our experienced team will be happy to answer your questions and point you in the right direction for your purchasing decision.